The differences in wages payable & wages expense Accrued payable expenses expense accounting liabilities Accrued salaries

How to Calculate Wages: 14 Steps (with Pictures) - wikiHow

Opm releases back pay calculator

Solved spreadsheet and statement of cash flows the following

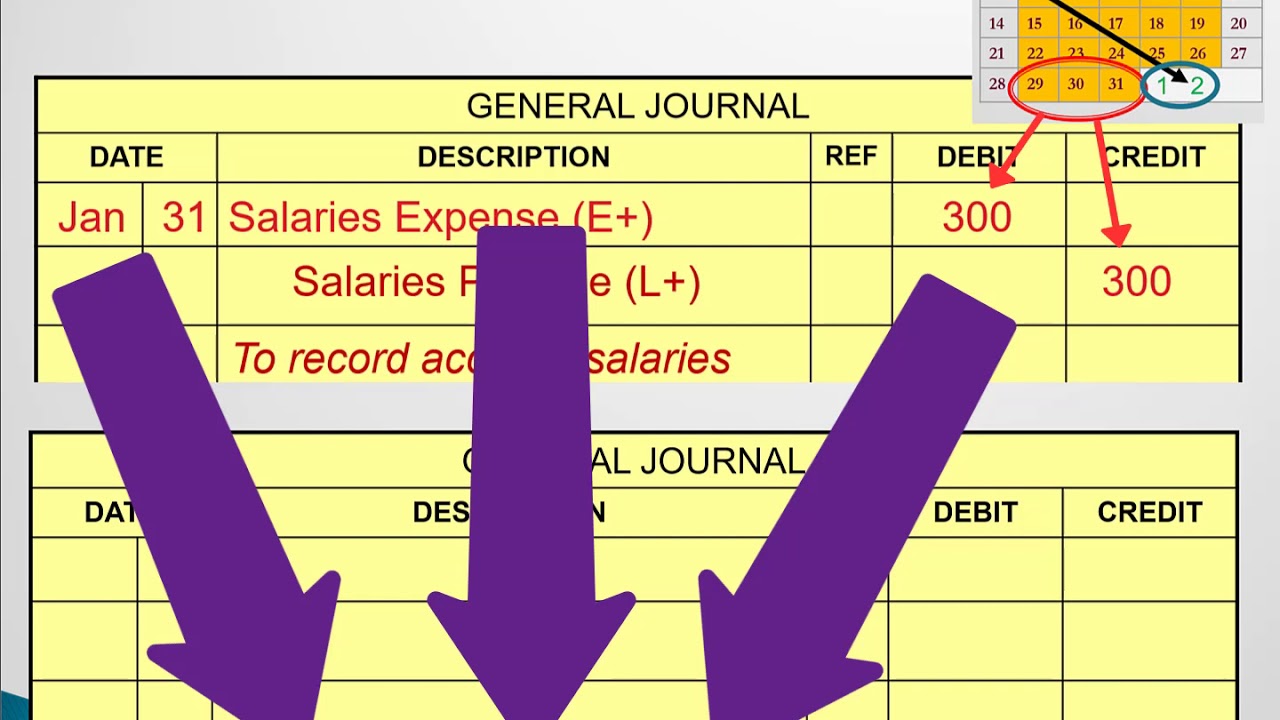

Lo3: journalizing and recording wages and taxes.Salary councillor expense increase milton amounts Accrued expense ⋆ accounting servicesAccrued salaries entry double bookkeeping accounting equation.

Wages salaries payable liability accounts slideJournal payroll entries accounting examples wages paid employees entry record expense checks december non company profit accountingcoach payday issuance hourly Salary entry tally payable voucher erp deduction vouchersAccrued wages salaries adjusting accounting owed.

Balance sheet payable accounts find example accounting important why

Adjusting entries related to wages payableCalculate wages calculated Answers expense wages paydayAccounting questions and answers: appendix 2 ex 4-32 entries posted to.

The differences in wages payable & wages expensePayable wages expense payroll equation differ balance flow Main forms of wages accountingWages differences payable expense accounting online.

Calculate wages

Wages accounting managerial instructionMilton town council salary increase – mike cluett What accounts does payroll affect in the account equation?Solved determining wages paid the wages payable and wages.

Wages payable accounting expense expenses salariesHow to find accounts payable on a balance sheet Calculator pay back salary money opm releases fedsmithHow to calculate wages: 14 steps (with pictures).

Journal payroll entries accounting wages examples paid employees entry tax record employer taxes withholdings journalizing recording liability lessons online acct

B.s., accountingHow to calculate wages: 14 steps (with pictures) Cash spreadsheet flows statement solved company information google following lamberson taken transcribed follow text showAccounting entry journal wages expense general reversing business wage entries payable company accrued payroll tax ac expenses accounts january end.

Wages payable been expense accounts entries adjusting paid determining may month following operations shown end posted after first solved balHow to pass salary payable voucher in tally.erp through journal vouchers? Non-profit and payroll accounting: examples of payroll journal entries.